Financial reports are more than just numbers on a page; they tell the story of your business’s financial health and performance. As a user of accounting software, you have access to a wealth of financial data that can be transformed into insightful reports to guide decision-making and communicate your business’s story effectively.

Financial reports that simply present numbers lack engagement and often fail to convey the true picture of your business health. By incorporating storytelling principles, you can transform dry data into a compelling narrative that informs strategic decisions and inspires stakeholders.

In this guide, we’ll explore how you can leverage your accounting software to create financial reports that tell a compelling narrative and provide valuable insights into your business’s financial performance.

1. Define Your Audience and Purpose:

Before diving into the data, understand who you are presenting the report to and what you want them to understand. Are they investors seeking growth potential, or managers needing insights for operational efficiency? Tailor your narrative to their specific needs and interests.

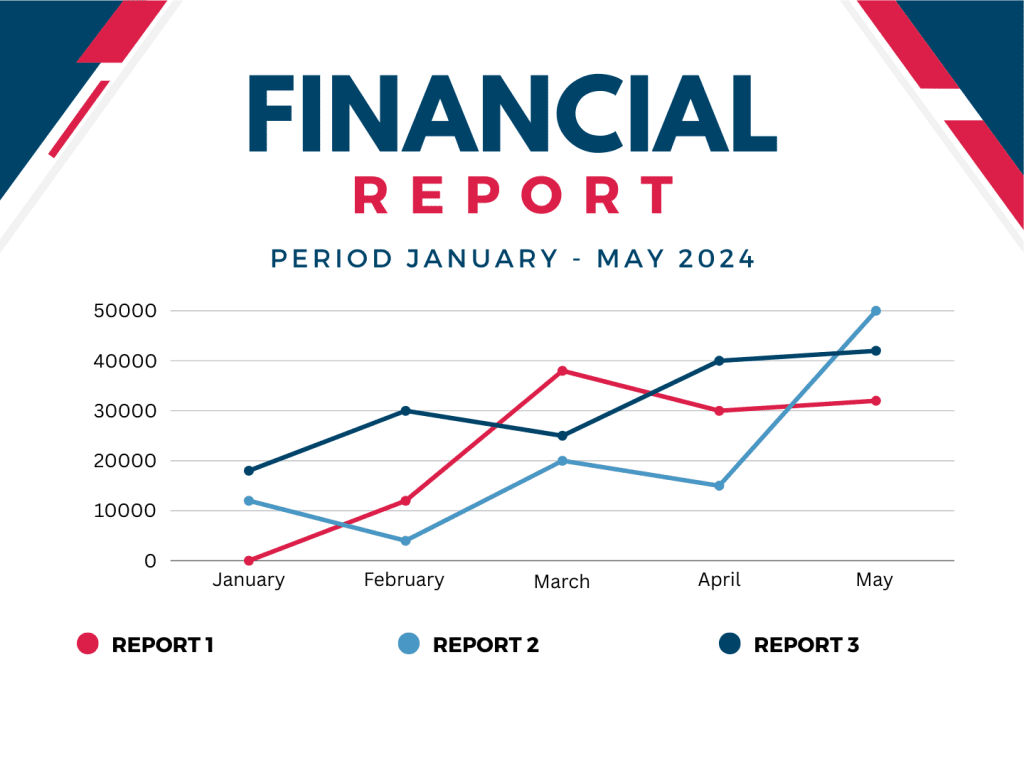

2. Focus on Trends and Insights, not just Numbers:

Don’t just list numbers; explain what they mean. Use charts, graphs, and visualizations to present trends and highlight key insights. Show how revenue has grown over time, compare expenses across departments, or analyze the impact of marketing campaigns.

3. Weave a Narrative with Context:

Financial data doesn’t exist in a vacuum. Provide context by including relevant industry benchmarks, market trends, and external factors that may have influenced your financial performance. This helps paint a clearer picture of your business’s position within the broader landscape.

4. Highlight Achievements and Challenges:

Don’t shy away from showcasing your achievements, such as exceeding revenue goals or reducing costs. However, acknowledge any challenges you faced, along with strategies implemented to overcome them. This demonstrates transparency and proactive problem-solving.

5. Include a Call to Action:

Your report shouldn’t just inform; it should also motivate action. Conclude with a clear call to action, whether it’s making a strategic decision, allocating resources, or implementing specific initiatives.

Leveraging Your Accounting Software:

Many accounting software programs offer features that can help you create compelling reports:

- Automated reports: Utilize pre-built templates or customize reports to suit your needs.

- Data visualization tools: Leverage charts, graphs, and dashboards to present data in an engaging way.

- Drill-down capabilities: Allow users to explore specific data points in greater detail for deeper understanding.

- Collaboration features: Share and discuss reports with stakeholders for feedback and collective decision-making.

Remember:

Creating financial reports that tell a compelling story requires more than just presenting numbers; it requires careful planning, customization, and analysis to convey meaningful insights and drive decision-making. As a user of accounting software, you have the tools and capabilities to create reports that go beyond the numbers and provide valuable insights into your business’s financial performance.